By the time monthly bills and everyday expenses are paid for, it can be hard to find extra money for savings. That’s where the “pay yourself first” method comes in handy. This budgeting strategy encourages setting aside money for things like retirement, savings and debt before paying for other variable expenses.

In 1926, George Clason wrote a book called The Richest Man in Babylon—one of the great success classics of all time.

It’s the fabled story of a man named Arkad, a simple scribe who convinces his client, a money lender, to teach him the secrets of money.

The first principle the money lender teaches Arkad is: “A part of all you earn must be yours to keep.”

He goes on to explain that by first putting aside at least 10% of his earnings—and making that money inaccessible for expenses—Arkad would see this amount build over time and, in turn, start earning money on its own.

Over an even longer time, it would grow into a lot, because of the power of compound interest.

Many people have built their fortunes by paying themselves first. It’s as true and effective today as it was in 1926.

In this guide, you'll learn the tips and strategies on how to pay yourself first which is the secret key to saving money and achieving financial success.

Keep reading I bet you'll love this in-depth guide because it is well researched and straight to the point.

#1. The Eighth Wonder of the World.

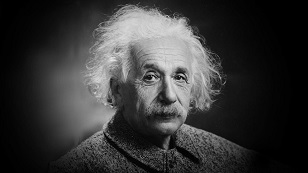

ALBERT EINSTEIN

Winner, Nobel Prize for Physics

Compound interest is the eighth natural wonder of the world and the most powerful thing I have ever encountered.

If you are new to the idea of compound interest, here’s how it works: If you invest $1,000 at a 10% rate of interest, you’ll earn $100 in interest and at the end of the first year have a total investment of $1,100.

If you leave both your original investment and the earned interest in the account, the next year you’ll earn 10% interest on $1,100, which is $110.

The third year, you’ll earn 10% on $1,210—and so on, for as long as you leave it there.

At this rate, your money would actually double every 7 years.

That’s how it eventually turns into a huge amount over time. Of course, the best news is, time is your friend when it comes to compound interest. The sooner you start, the greater the result.

Consider the following example.

Mary starts investing at age 25 and stops when she reaches 35. Tom doesn’t start investing until the age of 35 but keeps investing until he retires at 65.

Both Mary and Tom invest $150 per month, with a rate of return of 8% per year compounding interest. But look at the surprising result when they both retire at age 65.

Mary invested only $18,000 over 10 years and ended up with $283,385, whereas Tom contributes $54,000 over 30 years and ends up with only $220,233.

The person who contributed for only 10 years has more than the person who invested for 30 years but started later!

The sooner you start saving, the longer you have for compounding interest to work its powerful magic. It's the key to saving money and getting financial success.

In other words, pay yourself first.

#2. Pay Yourself First - Make Saving and Investing a Priority.

The world’s most aggressive savers make investing money as central a part of their money management as they do paying their mortgage.

To get in the habit of saving some money every month, immediately take a predetermined percentage of your paycheck and put it in a savings account that you don’t allow yourself to touch.

Keep building that account until you’ve saved enough to move it into a mutual fund or bond account or to invest it in real estate—including the purchase of your own home.

The amount of money that is wasted paying rent without building any equity in a home is a tragedy for many people.

Investing just 10% or 15% of your income will help you eventually amass a fortune.

Pay yourself first, then live on what is left.

This will do two things:

(1) it will force you to start building your fortune and

(2) if you still want to buy more or do more, it will force you to find ways to earn more money to afford it.

Never dip into your savings to fund your bigger lifestyle.

You want your investments to grow to the point that you could live off of the interest, if necessary. Only then will you be truly financially independent.

Don't Miss: 8 Steps on How to Focus On What You Want And Get Financial Success

Don't Miss: 12 Scientifically Proven Steps To Fix Your Limiting Beliefs About Money

#3. He Paid Himself First.

Dr. John Demartini is a chiropractor who now conducts seminars for other chiropractors on how to grow themselves personally and their practices financially.

He is one of the wealthiest and most abundant people you'll know— He said in one of his tapes:

When I first got into practice years ago, I paid everybody first and took whatever was left over.

I didn’t know any better. Then I noticed that people who had only been working for me less than 6 months were all getting paid on time. I realized that their pay was fixed and mine was variable. That was kind of crazy.

The most important person—me—was the one under the stress, while the others had all the stability.

I decided to turn that around and pay myself first. I paid my taxes second, my lifestyle budget third, and my bills fourth.

I arranged for automatic withdrawals, and they’ve completely changed my financial situation. I don’t waver.

If bills pile up and money doesn’t come in, I don’t stop the withdrawals.

My staff is forced to find a way to book more seminars and collect more money. Under the old system, if they didn’t book or collect, it was on my back.

But now, it’s the other way around. If they want to get paid, they figure out ways to make more money.

#4. The 50/50 Law On How to Pay Yourself First.

Another rule John suggests is that you never spend more than you save. John puts 50% of every dollar he earns into savings.

If he wants to increase his personal expenditures by $45,000, he first has to earn an additional $90,000.

Let’s say you want to buy a car for $40,000. If you can’t put an extra $40,000 into savings, you don’t buy the car. Either buy a cheaper car, make do with what you have right now, or go out and make more money.

The key to saving money is that you don’t raise your lifestyle until you’ve earned the right to raise it by putting the same amount into savings.

If you do raise your savings by $40,000, you know you’ve earned the right to raise your lifestyle by that same amount.

The 50/50 Law will get you rich very quickly. It was the core of billionaire Sir John Marks Templeton’s strategy for building wealth.

#5. Don’t tell Me You Can’t Do It!

Most people wait to start saving until they have some extra money lying around—a comfortable surplus. But it doesn’t work like that.

You have to start saving and investing for the future now!

And the more you invest, the sooner you will reach financial success and independence.

Sir John Marks Templeton started out working for $150 a week as a stockbroker.

He and his wife, Judith Folk, decided to invest 50% of their income in the stock market while still making tithing a priority.

That left the two of them only 40% of his income to live on.

But today, John Templeton is a billionaire!

He has kept the practice up his whole life and now gives away $10 for every dollar he spends to individuals and organizations that support spiritual growth.

#6. Who Wants to Be a Millionaire?

According to government figures, in 1980 there were 1.5 million millionaires in the United States.

By 2000 there were 7 million. Today on this date (of writing this article) According to a recent study, almost 24.5 million millionaires live in the U.S. today.

The number is expected to grow to approximately 50 million by the year 2030. It has been estimated that someone in America becomes a millionaire every 3 minutes.

With a little planning, self-discipline, and effort, one of these millionaires can be you.

#7. Millionaire Doesn’t Mean “Celebrity”.

Although you might think—judging from Donald Trump, Britney Spears, and Oprah Winfrey—that most millionaires are celebrities, the truth is more than 99% of millionaires are hardworking, methodical savers and investors.

These folks typically make their fortune in one of three ways:

From entrepreneurship, which accounts for 75% of all the millionaires in the United States; as an executive at a major corporation, about 10% of millionaires; or as a professional practitioner (doctor, lawyer, dentist, certified public accountant, architect).

Additionally, about 5% become millionaires through sales and sales consulting.

Don't Miss: 12 Ideas on How To Appreciate Someone And Build Your Success

Don't Miss: 11 Helpful Tips on How to Trust Your Intuition And Create Success

#8. Most Millionaires Work Hard And Pay Themselves First.

Indeed, most of U.S. millionaires are regular folks who worked hard, lived within their budgets, saved 10% to 20% of all their income, and invested it back into their businesses, real estate, and the stock market.

They are the people who own the dry cleaning business, the car dealership, the restaurant chain, the bread company, the jewelry store, the cattle ranch, the trucking company, and the plumbing supply store.

However, people from any walk of life can become millionaires if they learn the discipline of saving and investing and start early enough.

You no doubt read or heard about Oseola McCarty of Hattiesburg, Mississippi, who had to drop out of school in the sixth grade to take care of her family, and spent some 75 years of her life washing and ironing other people’s clothes.

She lived a frugal life and saved what she could from the little money she made.

In 1995, she donated $150,000, the bulk of her $250,000 life savings, to the University of Southern Mississippi to provide scholarships for needy students.

And here’s the interesting part:

Had Oseola invested her savings, which is estimated to have been about $50,000 in 1965, in an S&P 500 index fund, which earns on average 10.5% a year, her money would have grown to not $250,000, but $999,628—virtually a million dollars, four times as much.

#9. How to Become an “Automatic Millionaire”.

The simplest way to implement the pay yourself first plan is to have a plan that is totally “automatic”—that is, set up so a percentage of your paycheck is automatically deducted and invested as you direct.

You can arrange for the company to automatically deduct your contribution to the plan from your paycheck. If it’s deducted before you receive your check, you’ll never miss it.

More important, you won’t have to think about your investments—you won’t have to exercise self-discipline. It doesn’t depend on your mood swings, household emergencies, or anything else. You make the commitment once and it’s a done deal.

Another advantage of these kinds of plans is that they are free of most taxes until you withdraw the money.

So instead of having 70 cents working for you, you have an entire dollar working for you—compounding year after year.

#10. Educate Yourself Further To Save More Money.

As your money begins to grow, you’ll want to educate yourself further about the best way to invest your money.

Eventually, you’ll probably want to find a good financial advisor.

The way I found mine was to ask successful friends who they used, then listen for the same name to come up more than once or twice. That’s exactly what happened.

If you don’t have friends who are using a financial advisor go on the web you'll find many. But I request you to do your own research first.